how to calculate net debt from cash flow

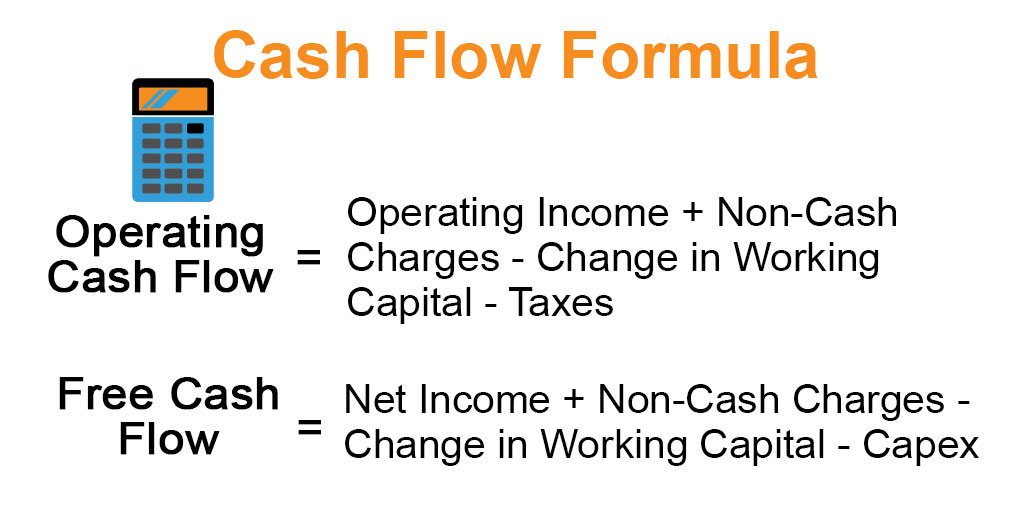

All non-cash items are added to your net income such as. The formula for calculating operating cash flow is as follows.

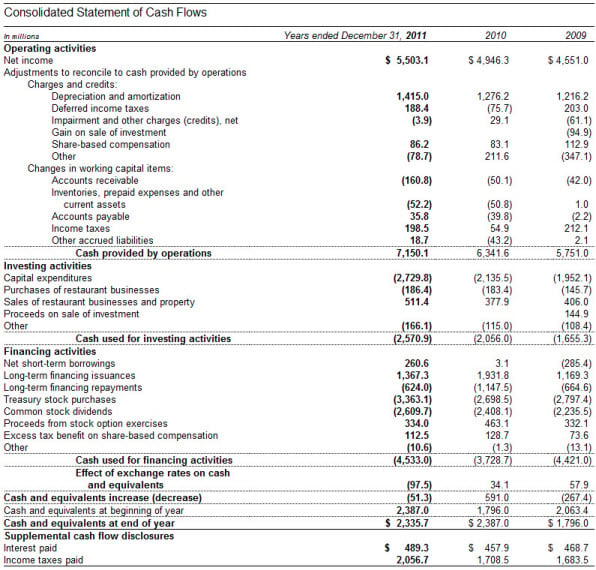

When calculating a statement of cash flow start by identifying the specific fiscal period you want to analyze.

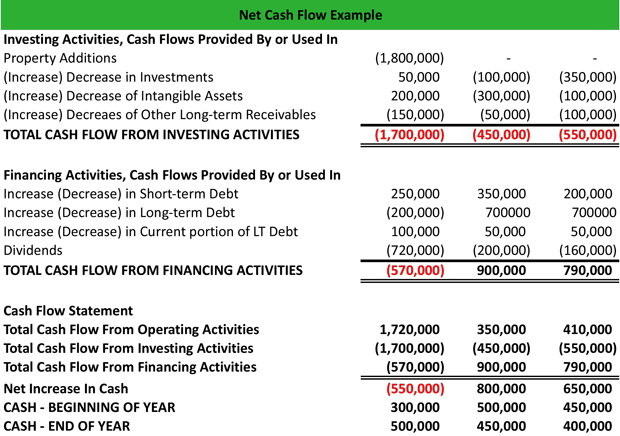

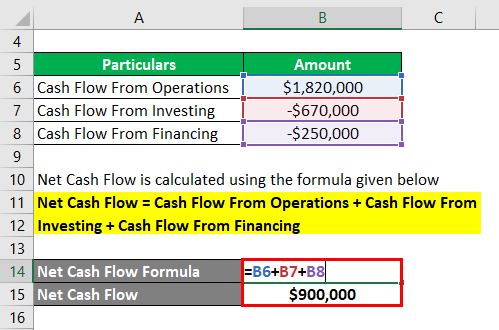

. Net Cash Flow Cash Flow From Operations Cash Flow From Investing Cash Flow From Financing. As stated earlier we calculate Net cash by deducting current liabilities Current Liabilities Current Liabilities are the payables which are likely to. Common examples of short-term debt include accounts payableAccounts PayableAccounts payable is a liability incurred when an organization receives goods or services fr.

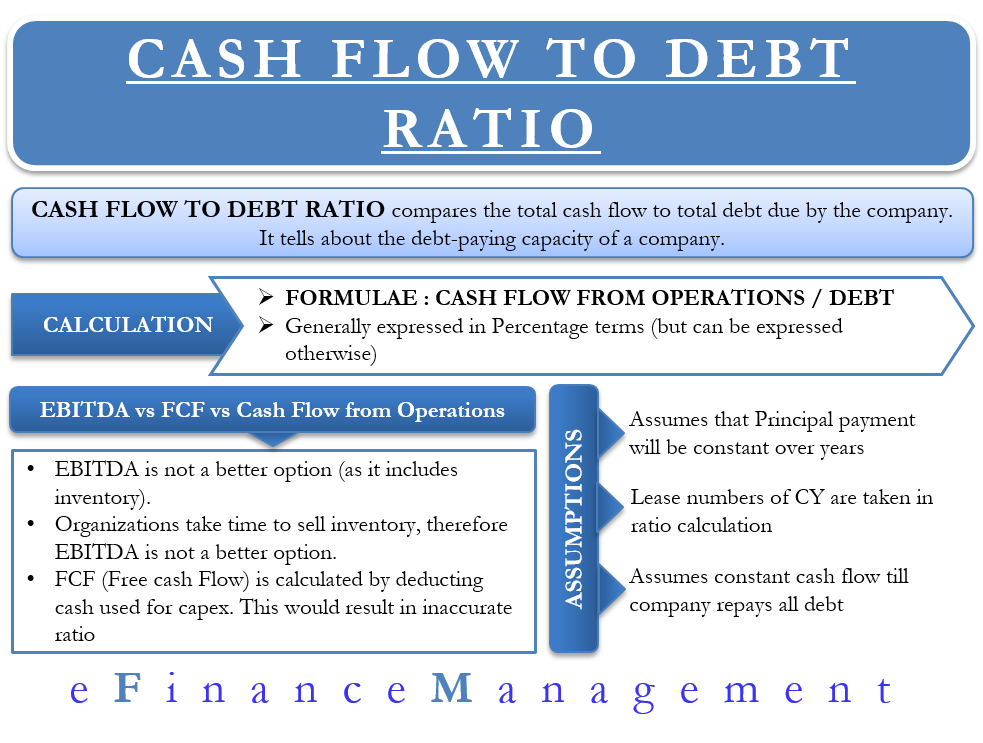

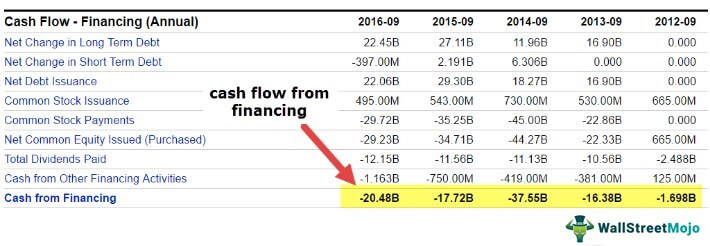

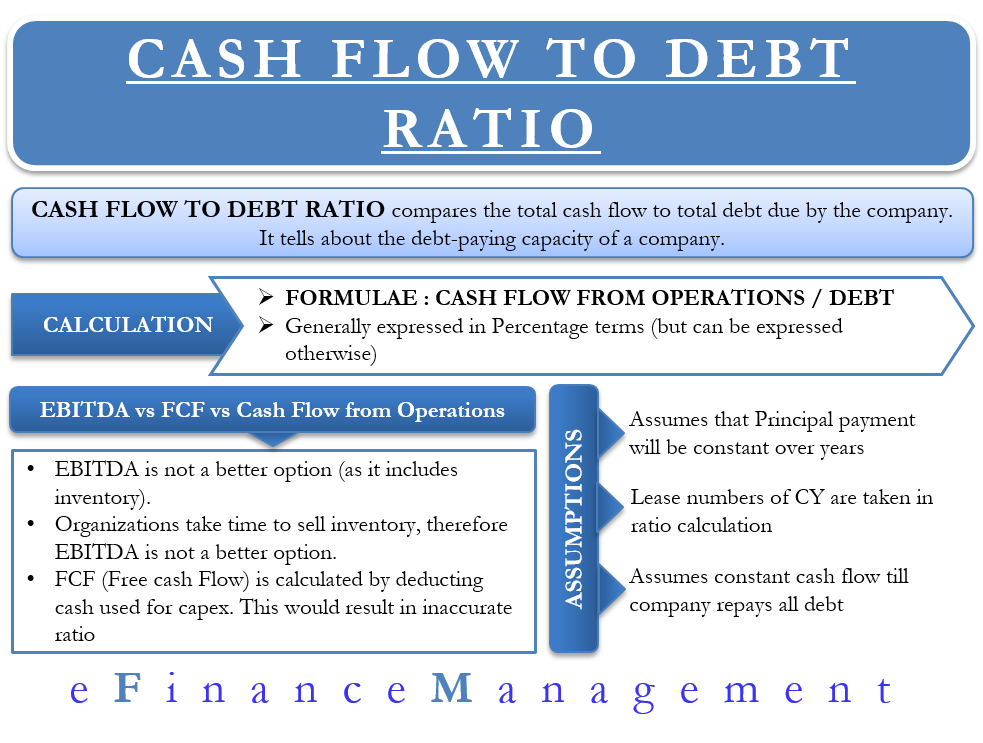

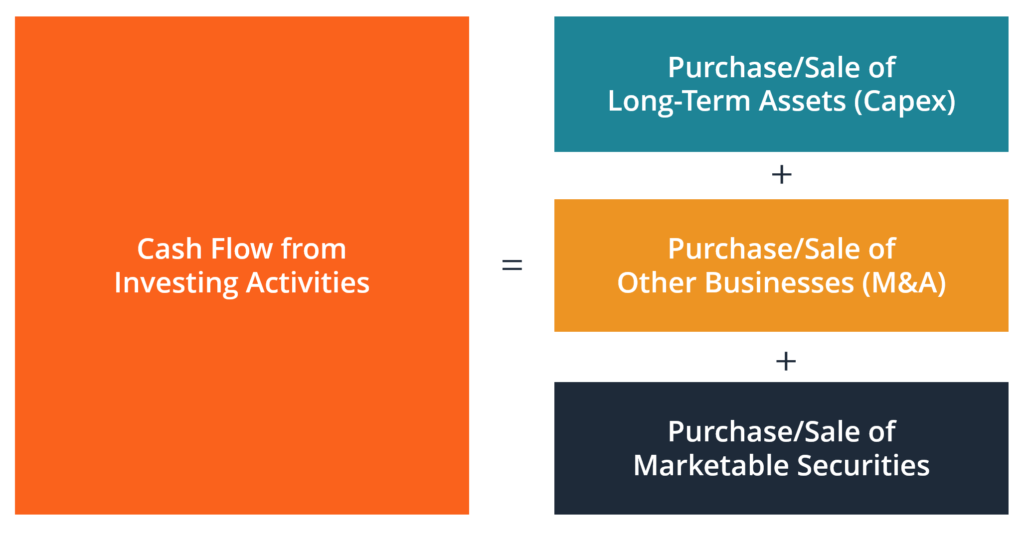

We can see from the cash flow statement that Wal-Mart used 6288 billion of cash to pay down short-term debt during the year while taking in 5174 billion of cash by borrowing more with long. Cash Flow Available for Debt Service CFADS Revenue Expenses - Net Working Capital Adjustments Capital Expenditures Cash Tax Other Items. The ratio is calculated by dividing the business cash flow from operations by its total debt.

Assume the salvage value of a machine after 5 years is equal to 5000. For the year 2018 stood at 5624 Mn. Identify your fiscal period.

Therefore the net cash flow of Apple Inc. Cash Flow Available for Debt Service CFADS Revenue Expenses - Net Working Capital Adjustments Capital Expenditures Cash Tax Other Items. Free cash flow is the cash that is left over after the company has accounted for all its expenditure.

Operating cash flows Total debt Cash flow to. The ratio reflects a companys ability to repay its debts and within what time frame. Calculation of the Equation.

2 5 2 5 beginaligned textCash Flow to Debt frac 312500 1250000 25 25 endaligned Cash Flow to. Free cash flow subtracts cash expenditures for ongoing capital expenditures which can. This is a simple example of calculating cash flow.

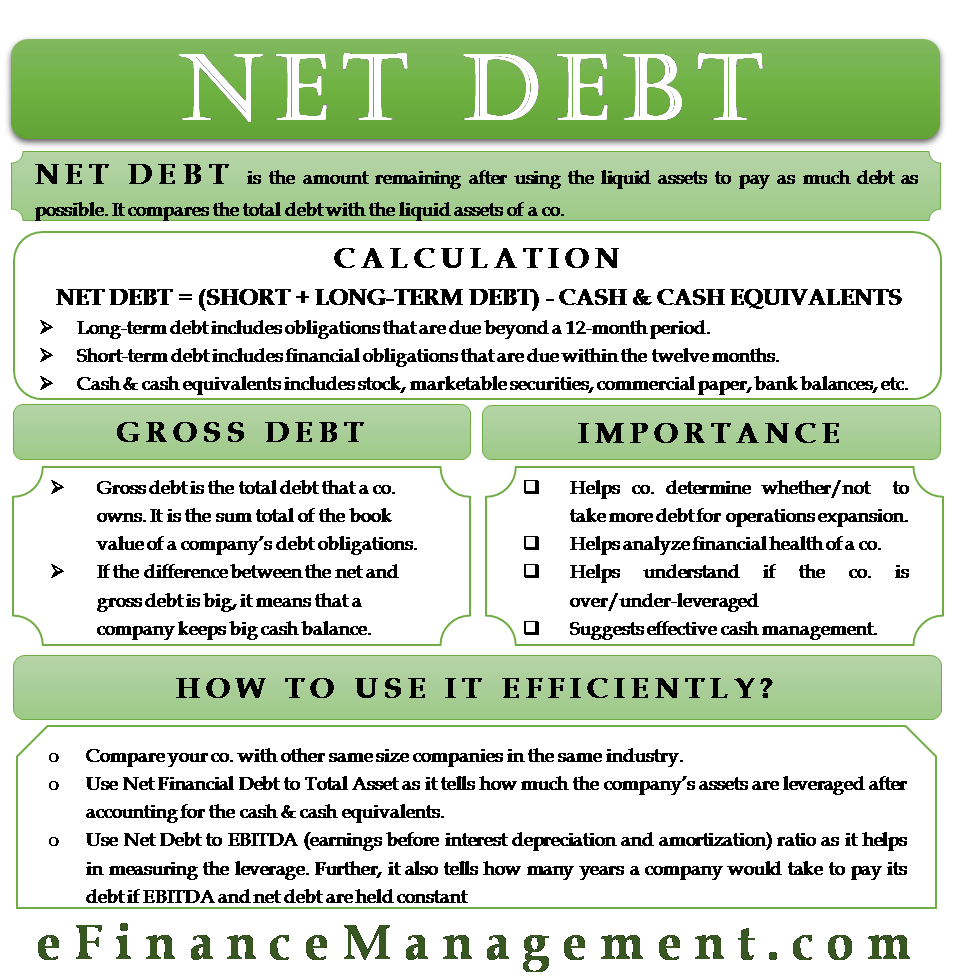

Expenses Operations maintenance land lease other labor etc. To calculate net debt we must first total all debt and total all cash and cash equivalents. The cash flow-to-debt ratio is a comparison of a firms operating cash flow to its total debt.

With the current figures in hand the accountants can also forecast the cash flow for a fixed period in the future. NCF total cash inflow - total cash outflow. Put simply NCF is a businesss total cash inflow minus the total cash outflow over a particular period.

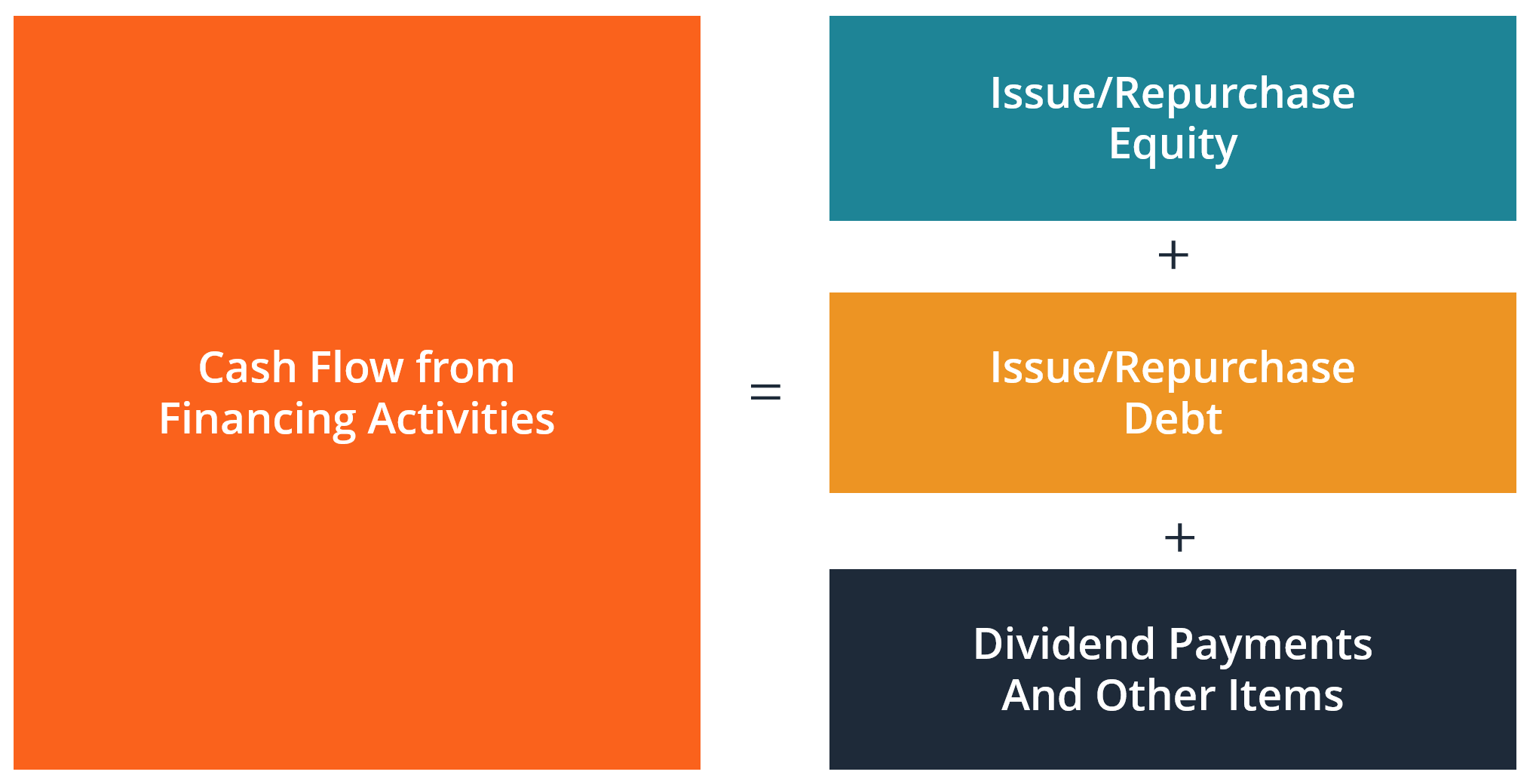

Lets break it down to identify the meaning and value of the different variables in this problem. Net Cash Flow from Financing Activities. Free cash flow or FCF is the cash that remains after cash payments that have been made to maintain operations and assets.

Revenue Revenue from operations other income. Therefore and as shown in the chart below to calculate operating cash flow youd start with the net income from the bottom of your income statement. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

We can use the above equation to calculate the same. Cash Flow Available for Debt Service CFADS Formula Definition. The cash flow to debt ratio is expressed as a percentage but can also be expressed in years by dividing 1 by the ratio.

Financial professionals calculate net cash flow with the following formula. Calculate the Sum of All Debt and Interest-Bearing Obligations Subtract Cash and Cash-Equivalents. As youll notice at the top of the statement the opening balance of cash and cash equivalents was approximately 107 billion.

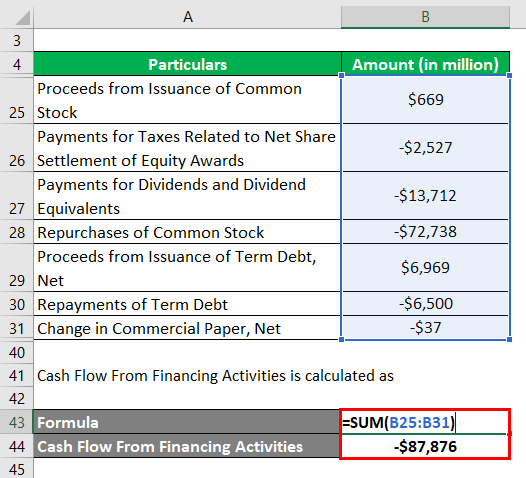

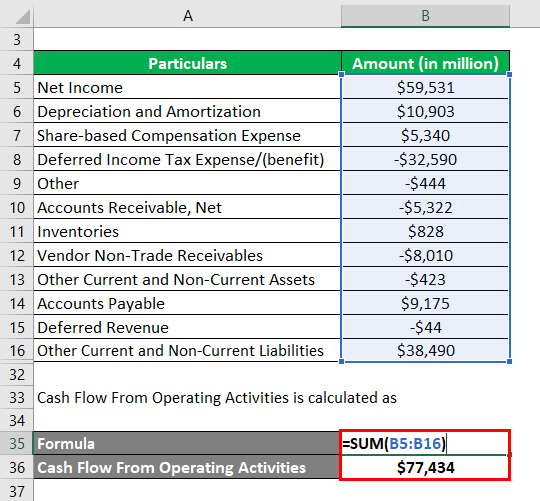

The above formula is the most typical way to calculate net cash flow because it can be done from a cash flow statement in Excel. However other ways to calculate net cash flow include. Net Cash Flow 77434 Mn 16066 Mn -87876 Mn Net Cash Flow 5624 Mn.

C a s h F l o w t o D e b t 6 2 5 0 0 0 2 5 0 0 0 0 0 2 5. Free cash flow is not the same as net income. You can calculate it by dividing the annual operating cash flow on the firms cash flow statement by current and long-term debt on the balance sheet.

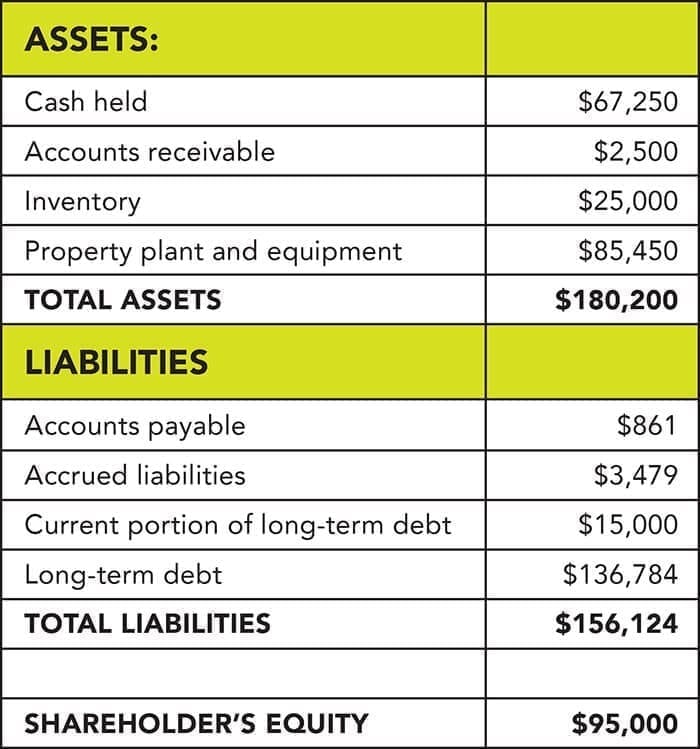

What is the Net Cash Flow Formula. In this calculation debt includes short-term debt the current portion of long-term debt and long-term debt. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

Cash flow from operations can be calculated using either the direct or indirect method. Operating cash flows Total debt Cash flow to debt ratio. Operating cash flow Net income Non-cash expenses Increases in working capital.

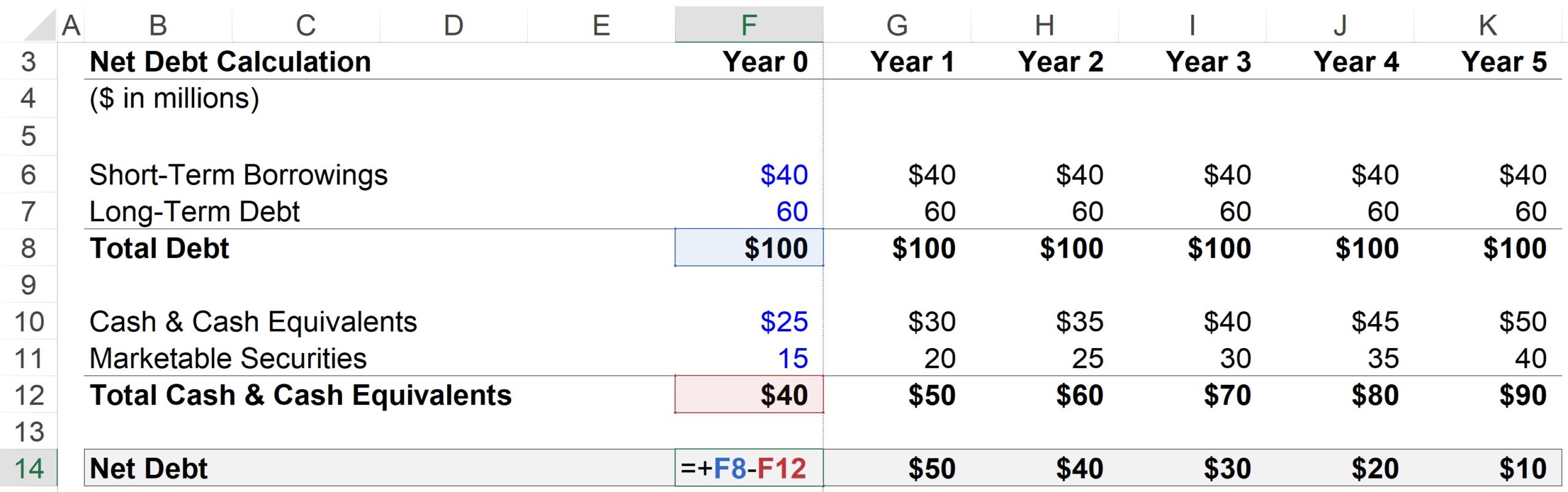

Text Cash Flow to Debt dfrac 625 000 2 500 000 25. A variation on this ratio is to use free cash flow instead of cash flow from operations in the ratio. Next we subtract the total cash or liquid assets from the total debt amount.

Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities Working method of operating cash flow is as follows. You might calculate it monthly quarterly or annually depending on the information you wish to measure. Heres how you can calculate a cash flow statement using this method.

Operating cash flow Net income Non-cash expenses Increases in working capital. Calculation of net cash flow can be done as follows. An extended formula is.

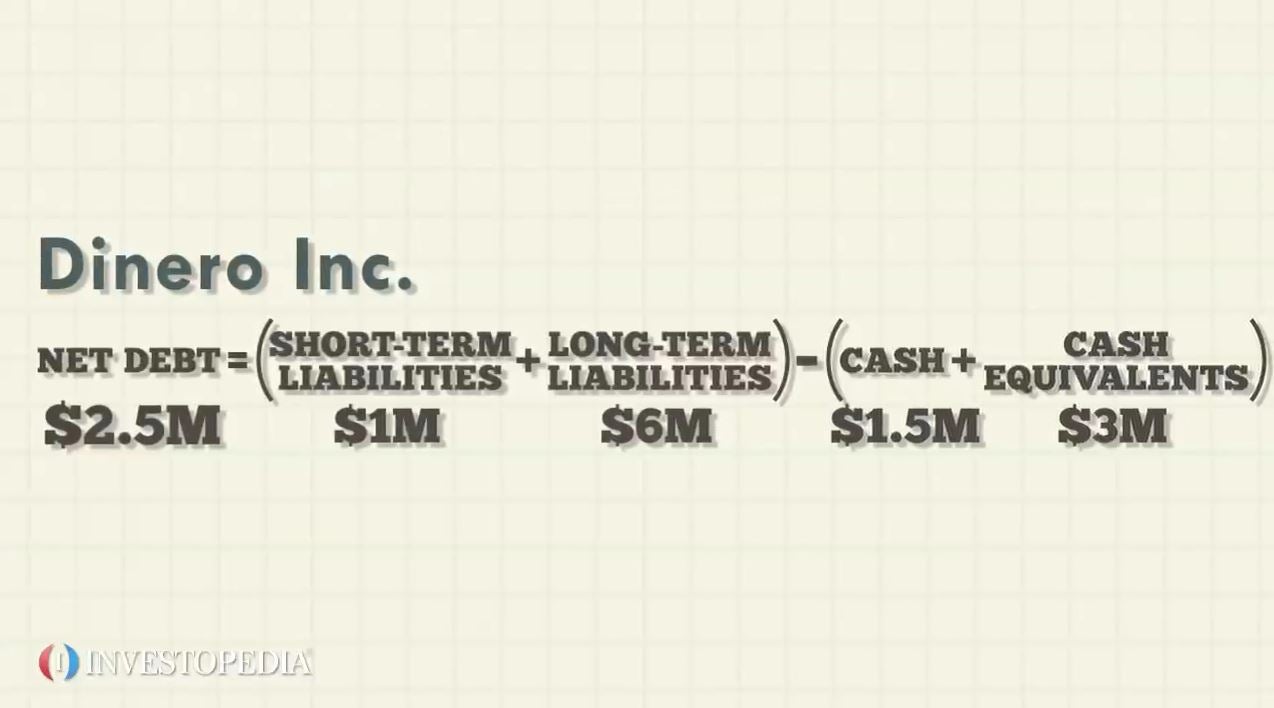

The net debt formula is calculated by subtracting all cash and cash equivalents from short-term and long-term liabilities. Net Cash Flow 100 million 50 million 30 million. Net Debt Short-Term Debt Long-Term Debt Cash and Equivalents Where.

NCF Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financial activities. To calculate net debt we must first total all debt and total all cash and cash equivalents. Net Debt Short-Term Debt Long-Term Debt Cash and Cash Equivalents.

Now lets use our formula and apply the values to our variables to calculate the cash flow to debt ratio. Calculating net debt consists of two steps. While net income measures the companys profitability free cash flow.

Short-term debtsare financial obligations that are due within 12 months. How to Calculate the Cash Flow to Debt Ratio. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure.

Net Cash Flow Operating Cash Flow Financing Cash Flow Investing Cash Flow. Net Cash Flow is calculated using the formula given below. This would tell us how many years it would take the business to pay off all of its debt.

Net Debt Formula And Excel Calculator

How Do Net Income And Operating Cash Flow Differ

Net Debt Formula And Excel Calculator

What Is Net Cash Flow Definition Meaning Example

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Cash Flow How To Calculate Vs Net Income Importance Analysis

Cash Flow From Financing Activities Formula Calculations

Net Cash Flow Formula Calculator Examples With Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow From Investing Activities Overview Example What S Included

How To Read A Cash Flow Statement Beginners Guide The Babylonians

What Is Net Debt Clydebank Media

Net Debt What It Is How To Calculate It And What It Tells

Net Cash Flow Formula Calculator Examples With Excel Template

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Cash Flow From Financing Activities Overview Examples What S Included

Net Cash Flow Formula Calculator Examples With Excel Template